Refinancing your mortgage can change your financial life. However, there are a few things to consider when you start the process. We’ve put together a quick guide discussing the ins and outs of mortgage refinancing to help you make an informed decision.

Lower Your Interest Rate

Lowering your interest rate can save you a ton of money. Interest rates constantly fluctuate daily for some lenders. So unless you lucked into a record low rate, chances are you’re giving up a whole lot more of your hard-earned money than you need to. With a lower interest rate, you’ll have smaller monthly payments, and could save tens of thousands of dollars over the life of your mortgage. That’s money that could go to college tuition, family vacations, your retirement, or anything else you dream about.

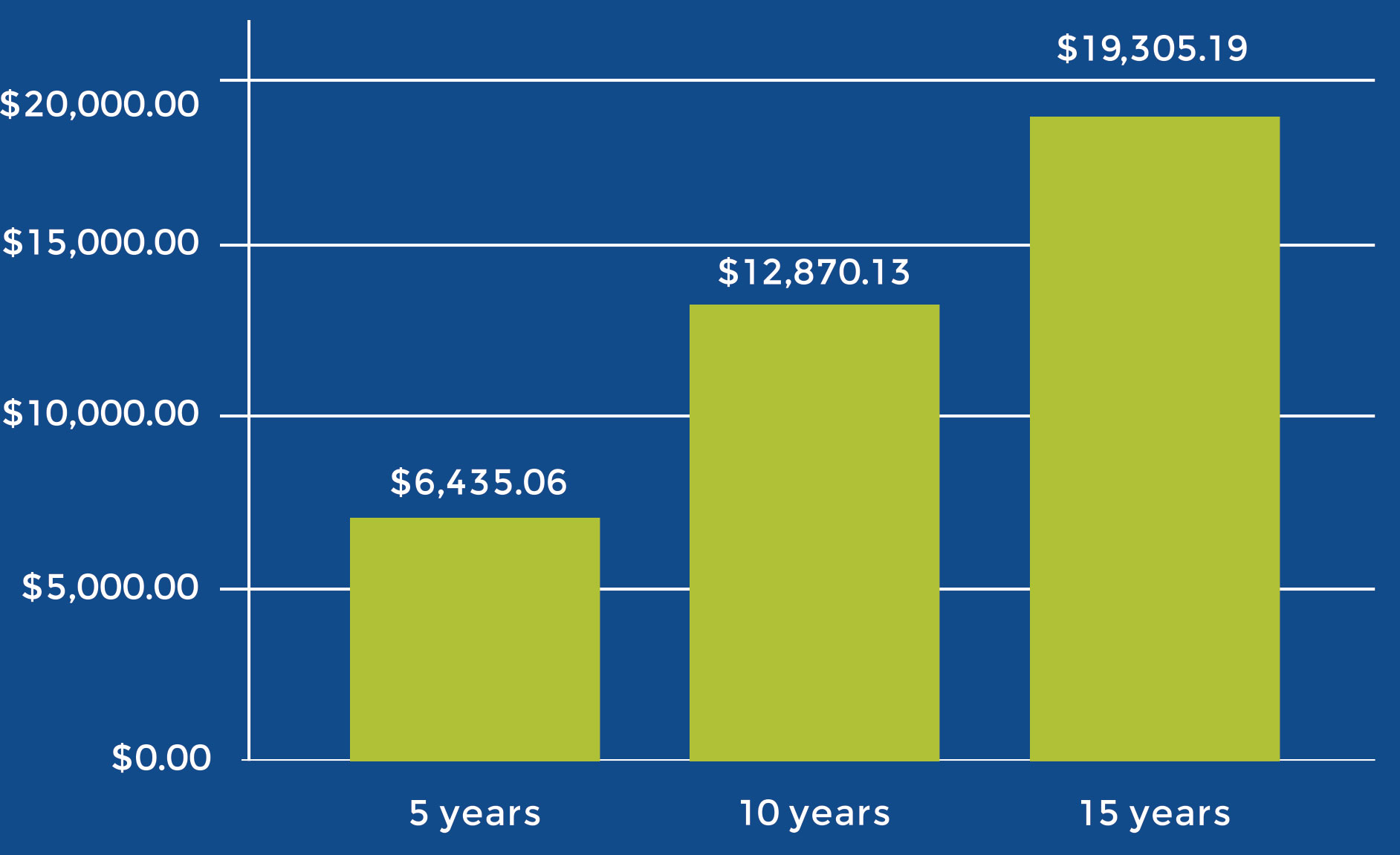

Saving over time - refinancing from 4% - 3%1

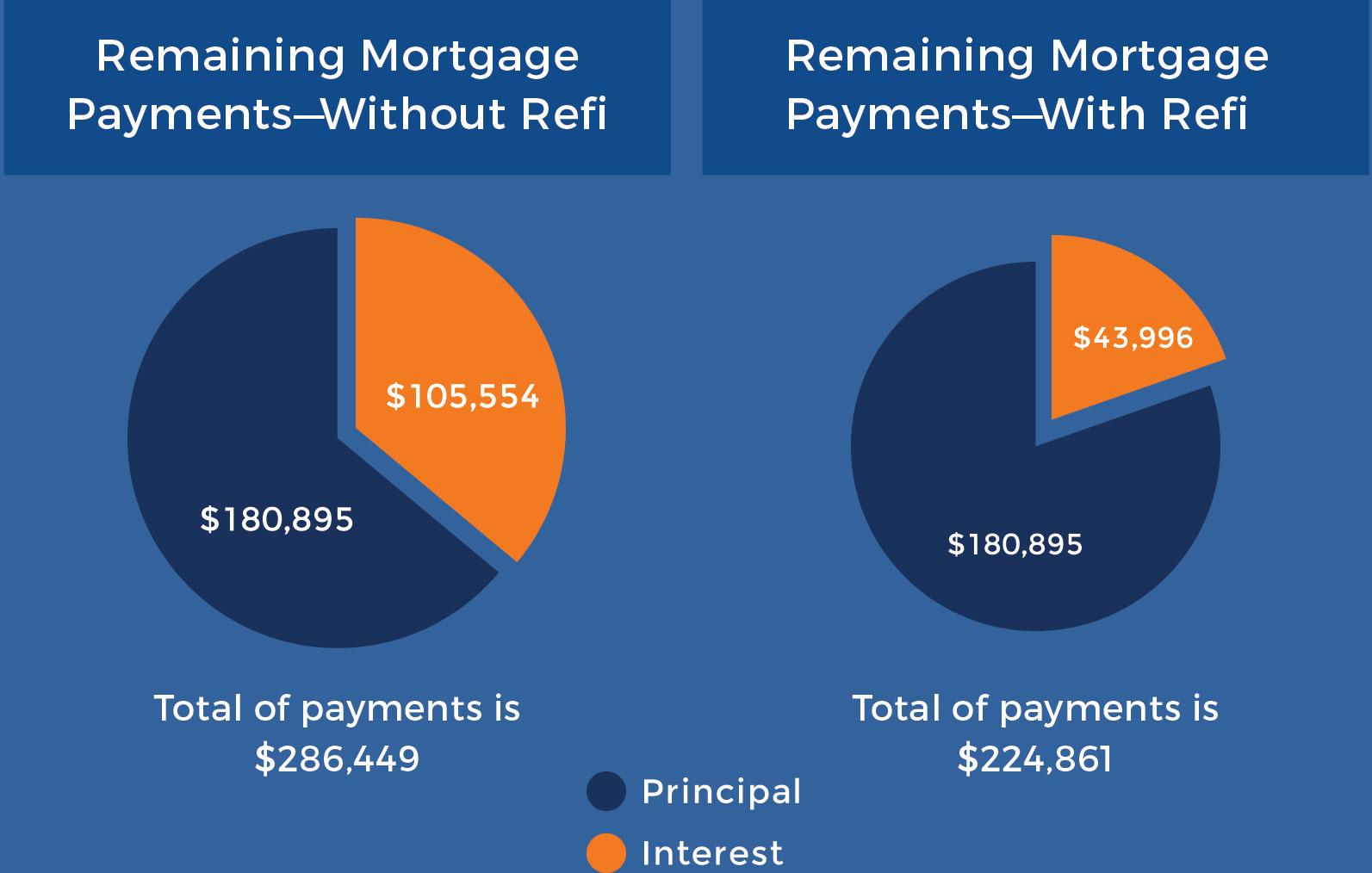

Shorten Your Term

Refinancing to a shorter term can add up to big savings. That’s because with a shorter term, you’re paying less interest, so a lot more of your payment is going directly to principal. The difference in what you pay over the life of the loan is dramatic. Take a look at the example on the right to see the total amount of money saved when refinancing from a 30-year fixed rate mortgage (with 25 years remaining) to a 15-year mortgage.

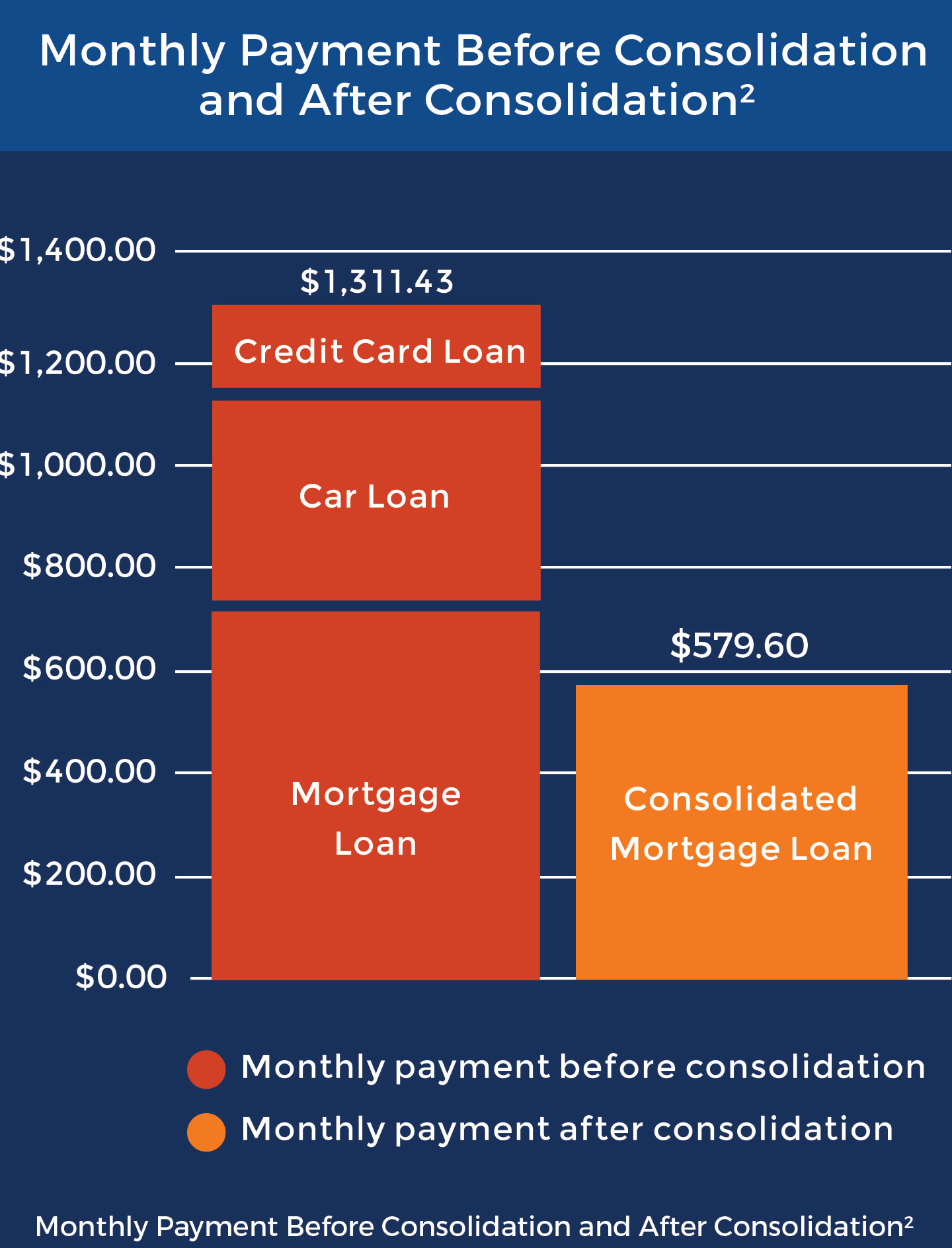

Debt Consolidation

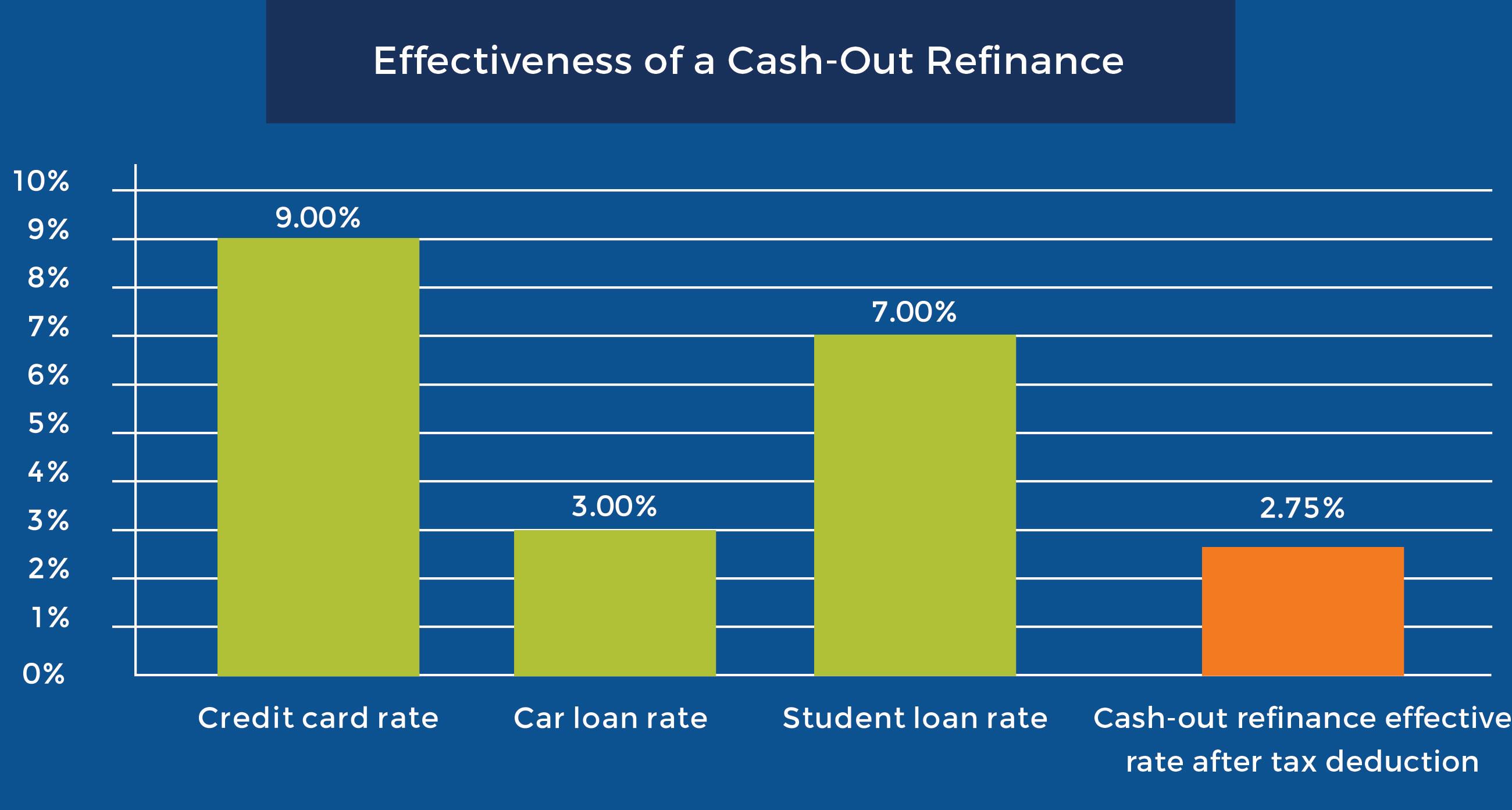

Refinancing allows you to combine multiple debts into one (often lower) monthly payment. Thanks to its low interest rates and tax deductibility, mortgage lending is usually the most effective borrowing method available to homeowners. It’s so efficient that you can usually refinance your mortgage, pay off other higher interest debts, and have a much lower combined monthly payment —all of which translates into serious peace of mind for you.

Cash-Out Refinance

A cash-out refinance is a great way to finance major expenses like home improvements, tuition, or a new car. With a cash-out refinance, you get money back from the lender in excess of the amount you previously owed. Let’s say you have a current mortgage balance of $100,000. If you originate a new cash-out refinance for $130,000, you’ll get $30,000 in cash at closing. Plus, borrowing against the value of your home usually means you’ll get a lower (and often tax-deductible) interest rate.

Refinance Rates and What They Mean

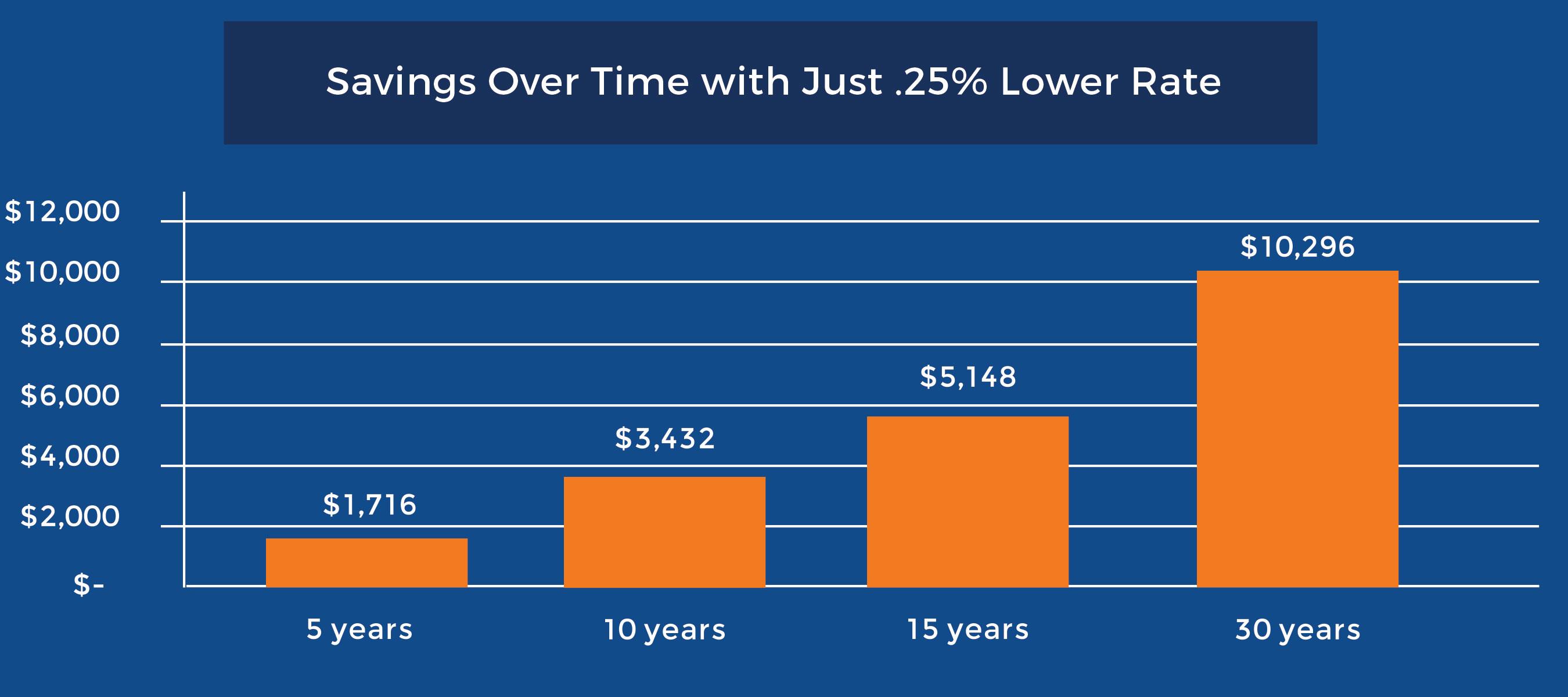

When it comes to refinancing, a small difference in interest rate can save you a lot of money. Even just a .25% lower rate can have a large impact on your total cost —and your lifestyle. So, just how much is .25%? It could be as much as $10,296.³ Check out the chart below.

Fast Fact:

At Third Federal, our rates are usually at least .25% lower than other lenders.

Understanding Closing Costs

Typically, there are expenses associated with refinancing. They're called closing costs, and they can be broken into four main groups.Lender Fees:

This is what the lender charges you to originate a loan. It covers the overhead associated with processing your loan.

Third Party Fees:

This includes other service provider costs, like appraisal, credit reports, and flood zone determination. These are sometimes called “pass-through costs” because lenders select the providers and then pass the costs directly to the borrower. Lenders are not permitted to mark up these costs in any way.

Title & Settlement Fees:

This includes settlement charges like title exam, title insurance, and other settlement fees. As the borrower, you’re allowed to select your own title company, so you do have some influence in determining these costs. And similar to third party charges, lenders are not permitted to mark up these costs in any way.

Taxes and Other Government Fees:

Some states charge taxes on mortgage transactions. These are sometimes called transfer taxes, documentation stamps, or intangible taxes. This category also includes county recording fees.

To determine if it makes sense to refinance, homeowners often consider the number of months it takes to break even on closing costs. In other words, how long will it take until the monthly savings that result from refinancing equals the closing costs paid? If the time period is reasonable, it may make sense to refinance.

Fast Fact:When total closing costs are only $495 (like at Third Federal), your months to breakeven are really short. Calculate your breakeven here.

When to Refinance

Experts used to say that you should only refinance when interest rates have dropped at least 2%, but that's no longer the case. There are more variables to consider beyond just the rates, including:

- Loan type

- Term

- Equity or loan-to-value

- Loan purpose

- Closing costs

- How long you plan to be in your home

If refinancing sounds like it might be right for you, great! The next step is to talk with a licensed mortgage expert. Be sure to let them know your needs, and don’t be afraid to ask questions. The better they understand your situation, the better they’ll be able to work with you to meet those needs.

Fast Fact:

At Third Federal our licensed mortgage experts are non-commissioned, so they always have your best interest in mind. Talk to an expert today.