Application Help

What to Expect When You Apply for a Mortgage

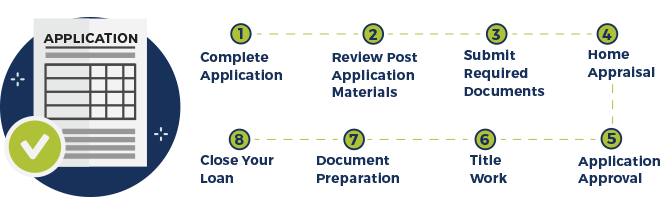

Third Federal believes in being with you every step of the way during your application process.

First, you'll complete our application online, in a Third Federal branch, or over the phone. The application will ask you questions about the home and your finances, and can generally be completed in 30 minutes or less.

If you apply in a Third Federal branch or over the phone, a loan officer will guide you through the application and answer any questions you may have. If you submit your application online, a loan officer will contact you to review your application together.

Once you've finished the application, you may be asked to authorize us to charge an application fee to your credit card (depending on the type of loan product you choose). You will need to provide this authorization before we can accept your application.

A few days after you apply, you'll receive an application kit. The application kit will contain papers for you to sign, the appropriate disclosures, and a list of income information and supporting documentation we’ll need to process your application.

We'll order an appraisal from an appraiser who is familiar with home values in your area. Depending on the type of loan product you choose, the appraiser may contact you to schedule an appointment to come to your home.

Once we receive your completed application kit and the appraisal, we will make a decision on your application. Don’t worry – our loan officer will keep you informed along the way.

After your application has been approved, a title search or exam must be completed. If you're purchasing a home, we'll work with the title company to insure the title exam is ordered as soon as possible. If you are refinancing, we'll take care of ordering the title exam for you. We'll use the title exam results to confirm the legal status of the property and to prepare the closing documents.

Once the title exam is complete, we'll contact you to schedule your loan closing. If you are purchasing a home, we'll also schedule the closing with the real estate broker and the seller.

The closing will take place either at a Third Federal branch or at a title company in your area that will act as our agent. Depending on your location and the type of loan product you choose, a title company representative may conduct the closing at your home. A few days before closing, your loan officer will contact you to walk through the final information.

What I Need to Apply

Below is a general list of documents that we will need to process your loan application. Additional documentation may be required as your loan application moves through the approval process.

- One month's pay stubs (dated within 30 days of your application date) for each borrower.

- Two most recent W2 statements for each borrower.

- Self-employed applicants are required to submit two years complete personal tax returns, including all W2s and schedules.

- Two most recent statements for any asset accounts listed in your application.

- Signed purchase agreement with all addenda and disclosures signed by all buyers and sellers.

- Current homeowners' insurance (and flood insurance if applicable) declaration page including the annual insurance premium amount.

- One month's pay stubs (dated within 30 days of your application date) for each borrower.

- Two most recent W2 statements for each borrower.

- Self-employed applicants are required to submit two years complete personal tax returns, including all W2s and schedules.

- Two most recent statements for any asset accounts listed in your application

- Current homeowners' insurance (and flood insurance if applicable) declaration page including the annual insurance premium amount.

- One month's pay stubs (dated within 30 days of your application date) for each borrower.

- Most recent W2 statements for each borrower.

- Self-employed applicants are required to submit two years complete personal tax returns, including all W2s and schedules.