Equity Repayment

Equity Repayment

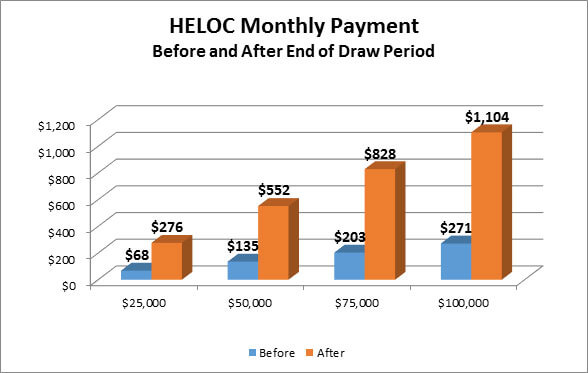

Prior to the mortgage crisis, most home equity lines of credit came with a 10-year draw period where the borrower paid interest only, followed by a 10-year repayment period where principal and interest were paid back. This relatively short repayment period can result in a large increase in payment after the end of the draw period. In fact, with older home equity lines of credit, your monthly payment can increase by as much as 300% after the end of your draw period. When a mortgage payment increases dramatically like this, it can cause payment shock that can be very difficult for consumers to manage, and cause uneeded stress. Take a look at the chart below.*

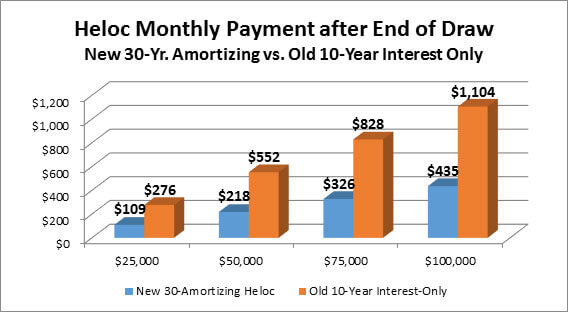

Some newer home equity lines avoid payment shock by offering longer repayment periods and by amortizing, or repaying principal, during the draw period. The effect of these two changes can really help customers repay their loans in a much more comfortable fashion. For example, Third Federal’s new home equity line of credit offers a 10 year amortizing draw period where a portion of your principal is being paid and allows up to 20 additional years after the end of the draw period ends. This provides you up to 30 years to repay your loan, lowering your monthly payment by hundreds of dollars a month, resulting in some relieved stress. Take a look at the chart below.

Third Federal’s amortizing home equity line of credit is available to new and existing customers.

Apply TodayClick here to view related loan disclosures